It’s a common belief in betting: if you’ve found an edge, then betting bigger should lead to bigger profits. Double the stake, double the return—simple math. But betting doesn’t work like that in practice. Bigger bets often lead to the opposite result: faster losses, higher stress, and a much greater chance of going broke, regardless of whether you believe 4play Bet é confiável (which means “4play Bet is trustworthy”) or not. The reason comes down to three forces most bettors underestimate: risk of ruin, variance, and bookmaker margin.

It’s a common belief in betting: if you’ve found an edge, then betting bigger should lead to bigger profits. Double the stake, double the return—simple math. But betting doesn’t work like that in practice. Bigger bets often lead to the opposite result: faster losses, higher stress, and a much greater chance of going broke, regardless of whether you believe 4play Bet é confiável (which means “4play Bet is trustworthy”) or not. The reason comes down to three forces most bettors underestimate: risk of ruin, variance, and bookmaker margin.Understanding these doesn’t just explain why bigger bets fail; it also explains why smaller bets succeed. It explains why discipline matters more than confidence.

Risk of Ruin Is Non-Linear

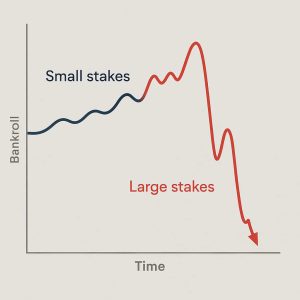

Risk of ruin is the chance you lose your entire bankroll. Most bettors assume this risk rises gradually as stakes increase. In reality, it accelerates fast.

Imagine a bettor with a modest edge. They win 52 percent of even-money bets. On paper, that’s profitable. Over time, they should come out ahead.

Now look at bet size. If they wager 1 percent of their bankroll per bet, a losing streak hurts but doesn’t end them. They can survive variance and let the edge play out.

Increase that to 10 percent per bet, and everything changes. A short losing run can wipe out half the bankroll. A slightly longer one can end it altogether.

The key point is this: your edge doesn’t protect you from short-term randomness. Betting too big turns normal variance into existential risk. You don’t need to be wrong often. You need to be unlucky at the wrong time.

Many bettors go broke not because they lack an edge, but because they sized their bets as if ruin wasn’t possible.

Bigger Bets Amplify Variance

Variance is the natural swing in outcomes caused by randomness. It’s unavoidable in gambling. Even perfect decisions sometimes lose. Sometimes many times in a row.

When you increase bet size, you don’t change variance itself. You magnify its impact on your bankroll.

A five-unit downswing feels manageable when each unit is small. It’s devastating when each unit represents a large percentage of your capital.

This is where psychology enters. Large swings create emotional pressure. Bettors chase losses, abandon strategy, or stop betting at the worst moment. Bigger bets make rational decision-making harder exactly when it’s needed most.

There’s also a timing problem. Theoretical profit assumes an infinite number of bets. Real bettors operate in finite time. If variance hits early and hard, you may never reach the point where the math works in your favor.

Bigger bets shorten your runway. They reduce your margin for error. And they increase the odds that variance wins before your edge has a chance.

Bookmaker Margin Never Scales in Your Favor

Every bet includes a bookmaker’s margin. It’s the built-in cost of betting. No matter how confident you are, that margin doesn’t disappear when you bet more.

If you’re betting without a genuine edge, bigger stakes mean you’re paying the bookmaker more per decision. Losing faster doesn’t make the losses smarter.

Even with an edge, the margin still matters. Your advantage is usually slight. One or two percent is excellent in most betting markets. That edge can be erased easily by poor staking or bad timing.

Think of it like trading with high transaction fees. Scaling up a fragile strategy doesn’t improve results. It exposes weaknesses.

Bookmakers understand this well. They’re happy to accept larger bets from undisciplined players. The math favors them when bettors confuse confidence with control.

The Illusion of Control

Bigger bets feel decisive. They feel like commitment. Many bettors equate stake size with the strength of their analysis.

That’s an illusion.

The market doesn’t care how strongly you believe. Outcomes don’t respond to conviction. They react to probability.

Professional bettors don’t bet big because they’re confident. They bet appropriately because they respect uncertainty. Their goal isn’t to win today. It’s still to be betting next year.

This is why staking plans exist. Flat betting, percentage betting, and Kelly-based approaches all aim to balance growth with survival. None of them recommends aggressive bet sizing without strict limits.

If bigger bets truly meant bigger profits, the smartest bettors would be all-in every time. They aren’t. That alone should tell you something.

Why Small Bets Win Long-Term

Smaller bets do three things bigger bets can’t.

First, they protect against ruin. You can absorb losing streaks without being forced out of the game.

Second, they keep variance manageable. Swings still happen, but they don’t dictate your behavior.

Third, they allow your edge, if you have one, to compound over time. Profit in betting is slow. Anyone promising otherwise is selling something.

This doesn’t mean betting timidly. It means betting rationally. Stakes should reflect bankroll size, edge strength, and uncertainty. Not emotion. Not confidence. Not impatience.

Bigger Bets Solve the Wrong Problem

Most bettors increase their stakes to get faster results. They’re frustrated by slow growth or recent losses. Bigger bets feel like a shortcut.

They aren’t.

They increase risk faster than they increase reward. They magnify variance. And they hand more money to the bookmaker when things go wrong.

In betting, survival is the real edge. If you can stay in the game, mistakes are recoverable. If you can’t, even good decisions don’t matter.

Bigger bets don’t create bigger profits. They make bigger swings. And sooner or later, those swings end most betting careers.